What is Retirement Planning? Steps and Stages

March 5, 2025

Decoding retirement planning steps and stages for a secure future. Explore key components and strategies today!

Understanding Retirement Planning

In order to embark on a successful retirement journey, it is essential to first grasp the fundamentals of retirement planning. This entails understanding the definition of retirement planning, recognizing its significance, and familiarizing oneself with the key components integral to a secure retirement future.

Definition of Retirement Planning

Retirement planning can be defined as the systematic process of setting financial goals and creating a strategic roadmap to ensure a financially stable and fulfilling retirement. It involves assessing one's current financial situation, projecting future retirement needs, and implementing effective strategies to achieve those goals.

Importance of Retirement Planning

Retirement planning holds paramount importance in securing a comfortable and stress-free retirement phase. By engaging in proactive retirement planning, individuals can safeguard themselves against financial uncertainties, maintain their desired standard of living, and achieve financial independence post-retirement.

Key Components of Retirement Planning

Retirement planning encompasses various key components that work together to pave the way for a successful retirement. These components include:

Key Components of Retirement Planning

Setting realistic retirement goals

Estimating retirement expenses

Building a retirement savings fund

Diversifying investment portfolio

Managing risks and uncertainties

Considering healthcare and insurance needs

Understanding and integrating these components into one's retirement planning framework is crucial for ensuring a secure and prosperous retirement future. By addressing each component diligently, individuals can navigate through different stages of retirement with confidence and financial stability.

Early Career Stage

When embarking on the journey of retirement planning during the early stages of one's career, it is essential to lay a strong foundation by focusing on setting financial goals and establishing a savings plan.

Setting Financial Goals

Setting clear and achievable financial goals is the first step towards effective retirement planning. Financial goals provide a roadmap for saving and investing, guiding individuals towards a financially secure retirement. These goals can include factors such as desired retirement age, income needed for retirement, and specific financial milestones to reach along the way.

Establishing a Savings Plan

Alongside setting financial goals, establishing a structured savings plan is crucial in the early career stage of retirement planning. Saving early and consistently can significantly impact the growth of retirement funds over time. By determining a percentage of income to allocate towards retirement savings, individuals can build a nest egg that will support their desired lifestyle during retirement.

By focusing on setting financial goals and establishing a disciplined savings plan early on, individuals can effectively kickstart their retirement planning journey and set themselves up for a financially secure future.

Mid-Career Stage

As individuals progress through their careers, the mid-career stage becomes a pivotal period for assessing retirement needs and strategically diversifying investments to secure a stable financial future.

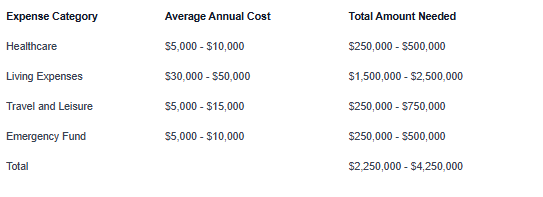

Assessing Retirement Needs

During the mid-career stage, it is essential to conduct a thorough assessment of one's retirement needs. This involves evaluating anticipated expenses post-retirement, including healthcare costs, living expenses, and leisure activities. By estimating these costs early on, individuals can develop a clearer financial roadmap for their retirement years.

Diversifying Investments

As individuals approach the mid-career stage, it is prudent to diversify investment portfolios to mitigate risk and maximize potential returns. Diversification involves spreading investments across various asset classes, industries, and regions to reduce exposure to any single risk factor.

Diversifying investments not only helps in safeguarding against market fluctuations but also enhances the potential for long-term growth. By striking a balance between risk and reward through diversification, individuals can build a robust financial foundation for their retirement years.

Navigating the mid-career stage of retirement planning involves a strategic approach towards assessing future financial needs and optimizing investment strategies. By proactively evaluating retirement requirements and diversifying investments, individuals can enhance their financial readiness and set themselves on a path towards a comfortable retirement lifestyle.

Pre-Retirement Stage

As individuals approach the pre-retirement stage, it becomes imperative to focus on reviewing retirement accounts and creating a retirement budget to ensure a smooth transition into retirement.

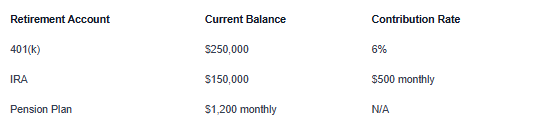

Reviewing Retirement Accounts

One of the essential steps during the pre-retirement stage is to thoroughly review all retirement accounts, including employer-sponsored plans like 401(k)s, IRAs, and other investments. By assessing the current status of these accounts, individuals can determine if their retirement savings are on track to meet their financial goals.

Regularly reviewing retirement accounts allows individuals to make any necessary adjustments, such as reallocating investments or increasing contributions, to ensure they are maximizing their savings potential and preparing adequately for retirement.

Creating a Retirement Budget

Creating a comprehensive retirement budget is another crucial step in the pre-retirement stage. By outlining expected expenses post-retirement, individuals can estimate their financial needs and determine if their retirement savings are sufficient to cover these expenses.

Developing a retirement budget allows individuals to identify areas where they may need to cut back on expenses or explore potential sources of additional income. It also helps in planning for unexpected costs and ensuring a financially secure retirement lifestyle.

During the pre-retirement stage, reviewing retirement accounts and creating a detailed budget are essential steps in the retirement planning process. By taking proactive measures to assess financial readiness and plan for retirement expenses, individuals can pave the way for a financially stable and fulfilling retirement journey.

Transitioning into Retirement

As individuals move into the transition phase of retirement, it becomes essential to focus on aspects such as Social Security and Medicare, along with implementing effective withdrawal strategies to ensure financial stability during this new phase of life.

Social Security and Medicare

Social Security and Medicare play pivotal roles in retirement planning, offering financial support and healthcare coverage for retirees. Understanding how these programs work and the benefits they provide is crucial for a smooth transition into retirement.

Implementing Withdrawal Strategies

Implementing strategic withdrawal strategies is key to managing retirement funds effectively. By determining the most suitable withdrawal methods, retirees can ensure a steady income stream that supports their lifestyle throughout retirement.

By incorporating these withdrawal strategies into their retirement plans, individuals can navigate the financial aspect of retirement with confidence and security.

Enjoying Retirement

As individuals transition into retirement, the focus shifts from actively planning for retirement to enjoying the fruits of their labor. During this phase, monitoring investments and adjusting plans as needed become essential to ensure financial stability and peace of mind.

Monitoring Investments

One key aspect of enjoying retirement is keeping a close eye on investments. Monitoring investments involves regularly reviewing the performance of financial assets such as stocks, bonds, and mutual funds. By tracking the growth or decline of investments, retirees can make informed decisions regarding their financial portfolio.

It is important for retirees to assess the risk tolerance of their investments as they shift from an accumulation phase to a preservation phase. Adjusting the asset allocation to align with their risk tolerance and financial goals can help maintain a balanced and diversified investment portfolio.

Regularly reviewing and reassessing investment strategies can help retirees stay on track towards their financial objectives and adapt to changing market conditions. Seeking the guidance of a financial advisor can provide valuable insights into investment performance and potential adjustment strategies based on individual retirement goals.

Adjusting Plans as Needed

As retirees progress through their retirement years, unexpected circumstances or life events may necessitate adjustments to their retirement plans. Adapting financial strategies and plans to accommodate changes in income, expenses, or health considerations is crucial for long-term financial security.

Retirees should periodically evaluate and reassess their retirement budget, taking into account any changes in expenses or income sources. Adjustments may need to be made to ensure that retirement funds are sufficient to cover ongoing living expenses, healthcare costs, and other financial obligations.

Maintaining open communication with financial advisors and revisiting retirement goals regularly can help retirees make informed decisions about adjusting their plans as needed. Flexibility and adaptability are key attributes in navigating the various stages of retirement and ensuring a comfortable and secure financial future.

Sources

https://www.investopedia.com/terms/r/retirement-planning.asp#:~:text=The%20process

https://www.iciciprulife.com/retirement-pension-plans/retirement-planning.html

https://www.ml.com/articles/planning-for-stages-of-retirement.html

.jpeg)

.avif)

.jpeg)

.jpg)

.jpeg)

.avif)

.avif)

.avif)